As the new year rolls around, many are thinking about fresh starts and new beginnings—not just in lifestyle changes, but in financial well-being too. If the past year saw more spontaneous spending than savings, now is the perfect time to take control of your finances. Imagine stepping into this year with a clear, manageable budget that aligns with your goals and aspirations. It doesn’t take a math whiz to make smart financial decisions—just dedication and a few strategic steps. We’re here to help you redefine your approach to budgeting, ensuring that monetary health is part of your successful 2026.

This post contains affiliate links, meaning I may earn a commission from purchases, and includes contentcreated with AI assistance for enhanced clarity.

Section 1: Set Clear Financial Goals

The first step in any successful budgeting plan is clarity on your financial goals. Whether you’re saving up for a big purchase, planning a vacation, or aiming to clear debt, define what success looks like to you. This involves prioritizing short-term targets and aligning them with long-term ambitions for a seamless financial journey.

Shop the Look:

Dos & Don’ts:

- Do write down your financial goals in clear terms.

- Don’t set unrealistic expectations that can cause burnout.

- Do break down large goals into smaller, manageable steps.

- Don’t forget to review and adjust your goals regularly.

Section 2: Analyze Your Spending Habits

Understanding your spending patterns is crucial to effective budgeting. Start by tracking everything you spend for one month, using tools like budget-tracking apps or spreadsheets. This revelation might surprise you by showing where your money really goes. Once you have a clear picture, categorize your expenses—essentials like rent and groceries, and discretionary spending like dining out or entertainment. Identifying these patterns helps set realistic budgets for each category, enabling more control over your finances throughout the year.

Shop the Look:

Dos & Don’ts:

- Do track your expenses regularly for better insights.

- Don’t overlook small purchases—they add up!

- Do categorize expenses to find where to cut back.

- Don’t set unrealistic cuts; start with manageable changes.

Section 3: Create a Realistic Monthly Budget

Crafting a monthly budget is more than listing expenses—it’s about aligning your daily habits with your financial goals. Start by listing your income sources, then deduct fixed expenses such as rent, utilities, and insurance. Next, allocate funds to variable costs like groceries, dining out, and entertainment. Finally, set aside a percentage for savings and unexpected expenses. This dynamic approach to budgeting doesn’t just provide financial stability, it empowers you to take control and plan for the future. Remember to review and adjust your budget monthly to reflect any changes in income or expenses.

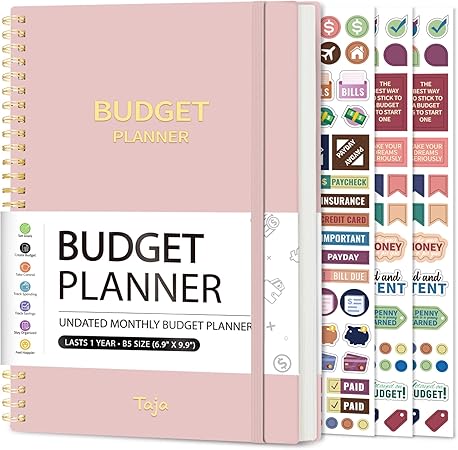

Shop the Look:

Dos & Don’ts:

- Do differentiate between needs and wants.

- Don’t ignore setting aside an emergency fund.

- Do update your budget regularly to accommodate changes.

- Don’t forget to celebrate small financial victories.

Section 4: Optimize Your Savings Strategy

Savings can feel elusive, but turning them into a reality often just requires a strategic approach. Start by automating your savings to ensure consistency—many banks offer this feature where a portion of your income is directly transferred to a savings account. Also consider setting specific, tangible savings goals, whether it’s building an emergency fund, buying a car, or planning a dream vacation. Use visual tools like goal-setting apps to track progress and stay motivated. Remember, every small saving counts towards building a bigger future.

Shop the Look:

Dos & Don’ts:

- Do automate your savings to ensure consistency.

- Don’t dip into your savings unless absolutely necessary.

- Do set clear, achievable savings goals.

- Don’t neglect comparing savings account options for better interest rates.

Section 5: Reevaluate and Reduce Unnecessary Expenses

Regularly reviewing your expenses helps identify areas to cut costs. Take a fine-tooth comb to discretionary spending, such as dining out, subscriptions, and impulse purchases. Explore alternatives that offer similar satisfaction for less—like cooking at home, choosing bundled streaming over multiple subscriptions, or engaging in free community events. This process not only boosts your savings but also promotes a mindful lifestyle where spending is a reflection of what truly matters to you.

Shop the Look:

- Budget-friendly cookbooks

- Subscription management tools

- Impulse spending apps

- Local event guidebooks

Dos & Don’ts:

- Do explore budget-friendly alternatives to expensive habits.

- Don’t cut so much that it affects your quality of life.

- Do regularly review and adjust discretionary expenses.

- Don’t underestimate small savings; they add up over time.

Affiliate Disclosure: This website contains affiliate links. As an Amazon Associate, I earn from qualifying purchases.

As we embark on the journey of 2026, taking control of our financial health becomes more than just a resolution; it’s a pathway to peace of mind and a more secure future. By setting clear financial goals, analyzing spending habits, creating a realistic budget, optimizing savings strategies, and reducing unnecessary expenses, you’re laying the foundation for financial stability and success. These steps not only empower you with better control over your money but also align your spending with your values and aspirations.

Successfully managing your finances in the new year requires commitment and a willing attitude to adapt as necessary. Remember that financial planning is not a one-time task but a continuous process of evaluation and adjustment. Celebrate your milestones—whether big or small—and let them fuel your motivation to stay on track.

Ultimately, a well-crafted budget is not just about numbers; it’s about making informed choices that bring you joy and security. As you implement these practical strategies, envision a year where your financial decisions support the life you envision for yourself. So step confidently into the new year, knowing that you have the tools and insights needed to navigate your financial journey with clarity and purpose.

By building these habits now, you set the stage for a future that reflects your true priorities and dreams. Here’s to making 2026 a year of financial empowerment and success!